With HiddenLevers you can easily create and share annuities across your organization.

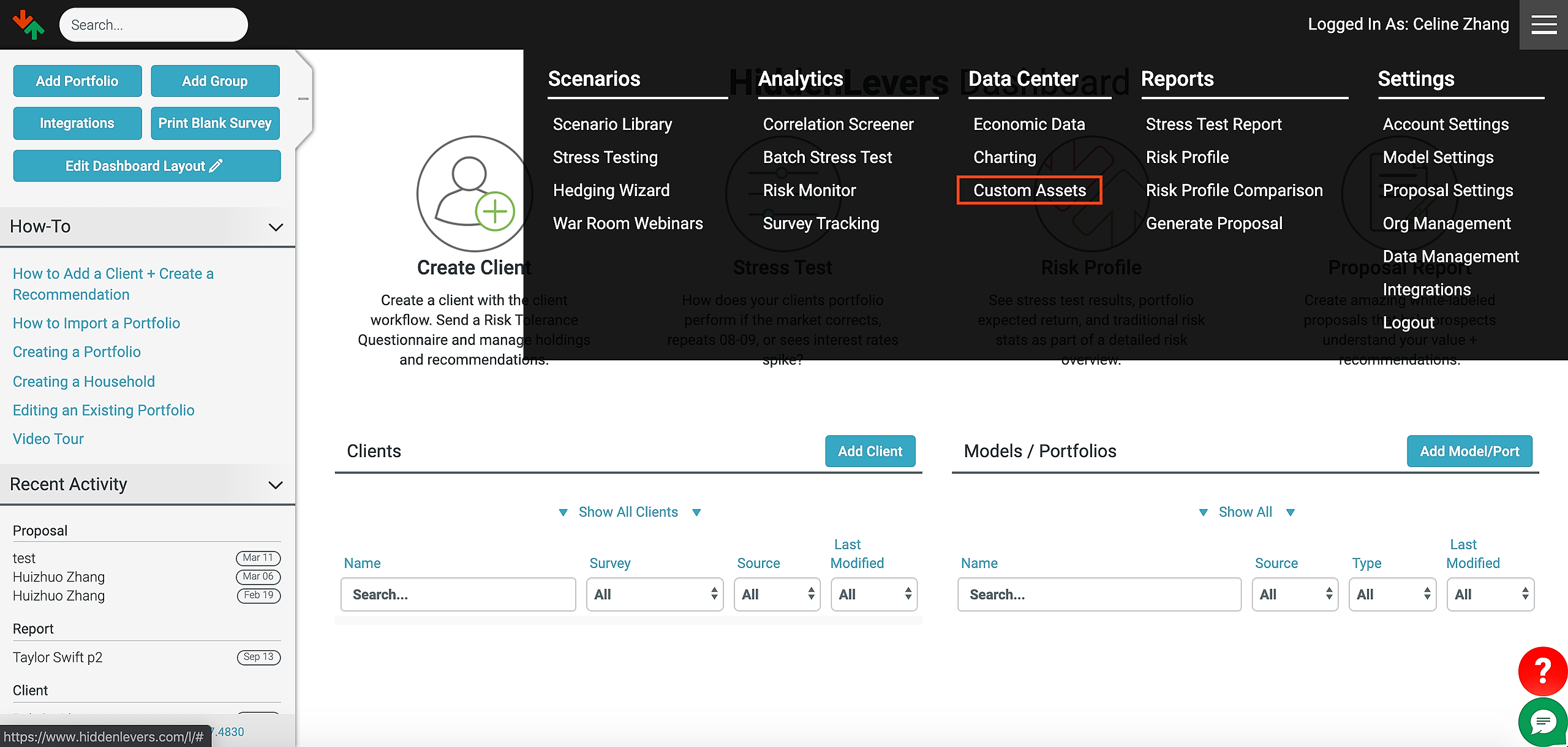

To get started, hover over the 3-line menu bar at the top right of the screen, and click on "Custom Assets" under "Data Center":

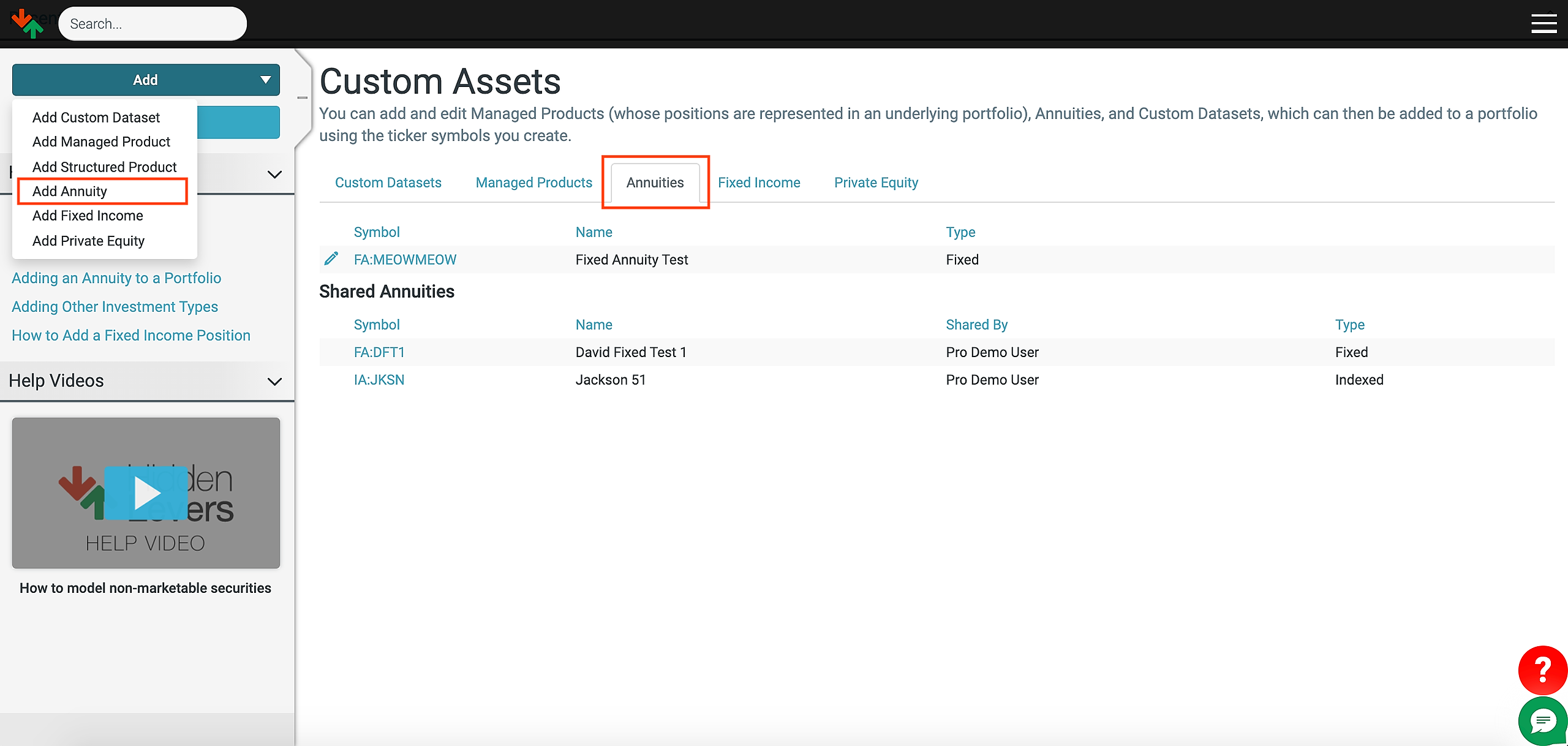

This will open the "Custom Assets" section of HiddenLevers. On the left sidebar, you will several blue action buttons. Click "Add" and select "Add Annuity."

If you aren't seeing this feature, please reach out to hiddenlevers@orion.com and we can help add this to your subscription.

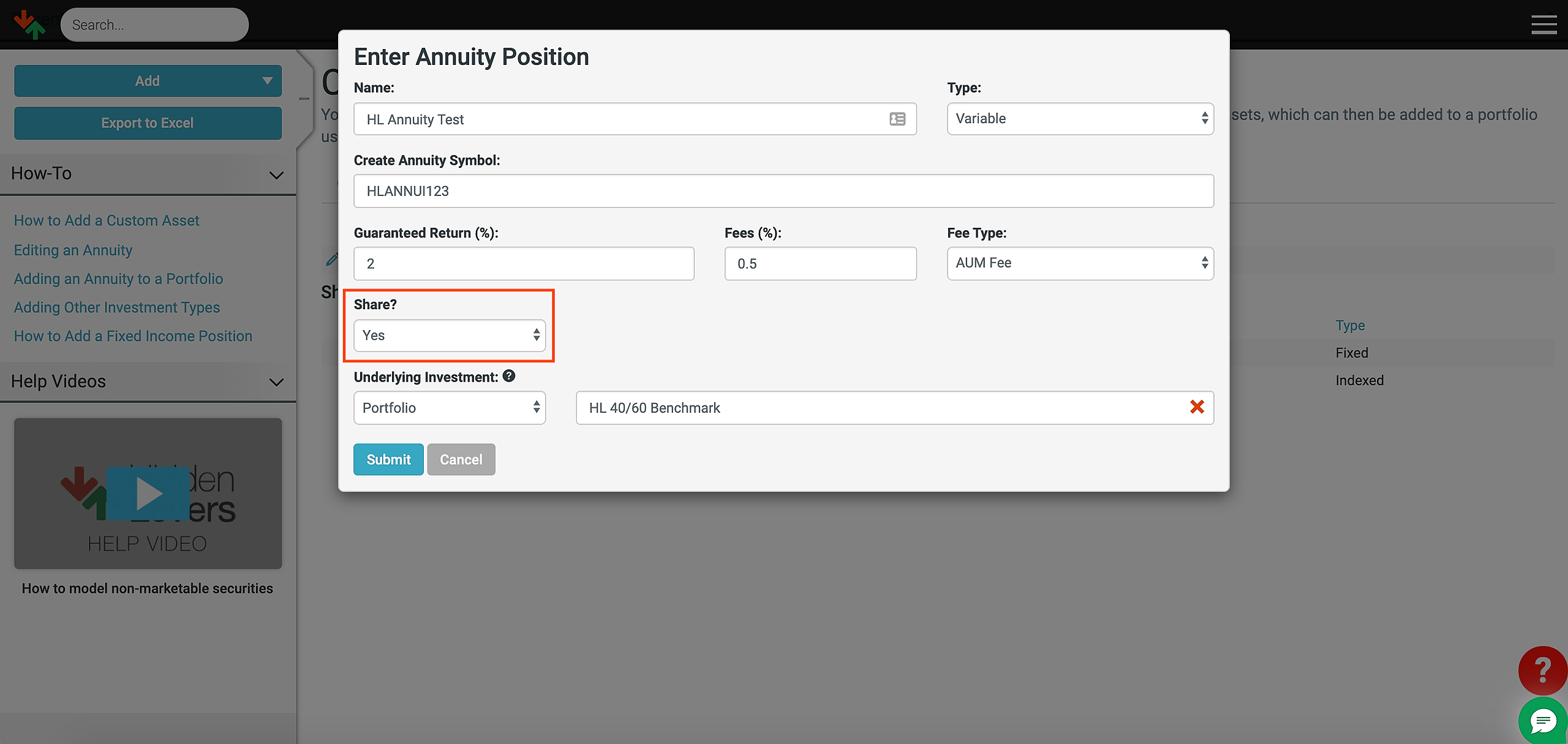

You will then see the "Enter Annuity Position" popup modal.

Here, you can enter the details of the annuity you are modeling.

Name - Enter the name of the annuity you want to create (e.g. Pru VA, Nationwide IA, etc.).

Type - Is this annuity Fixed, Indexed, or Variable?

Create Annuity Symbol - Here, you will create a unique ticker symbol for the annuity to use throughout the site. For example, if you enter "PRUANN23" and choose a Variable Annuity type, then the ticker will be "VA:PRUANN23"

Guaranteed Return(%) - Enter any guaranteed annual return the annuity might have.

Annual Fees (%) - If the annuity has annual fees, enter them here.

Share? - Select "Yes" will allow other users from your org to have access to this annuity

Underlying Investment - For indexed annuities, you can choose any publicly traded symbol or an index as the underlying investment. For variable annuities, you can choose a portfolio that represents a basket of investments that the variable annuity holds.

For indexed annuities, you can also set the following parameters:

Upside Cap(%) - What is the upside cap for the underlying investment. If you enter "5" then the annuity will capture the first 5% of any upside in the underlying investment.

Cap Period - Is the cap a monthly or annual cap?

Participation Rate (%) - How much does the annuity participate in the underlying investments return? For example, entering "30" means the annuity experiences 30% of the underlying investments return.

Once you enter all the information, click "Submit" and your annuity will be created and shows up on your annuity list which you can access from the "Annuity" tab.

Visit this article to learn how to add an existing annuity to a portfolio

Visit this article to learn how to edit an annuity in Custom Assets